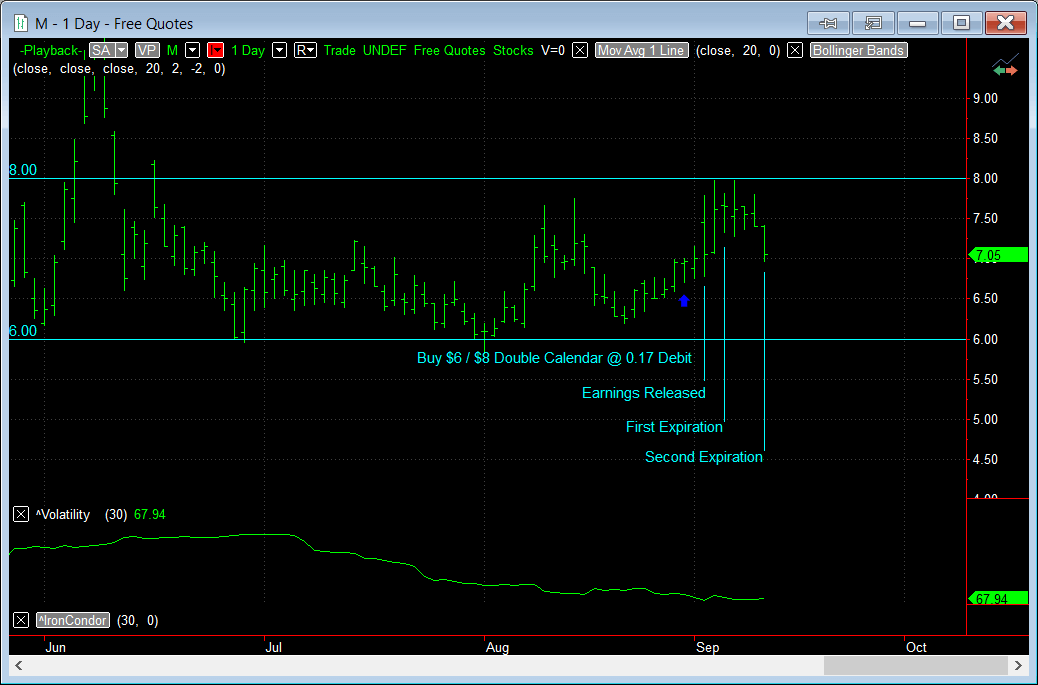

Reverse Calendar Spread 2024. Does anyone have/know of a broker that doesn't require full collateral when selling calendar spreads? i.e., doesn't treat the short leg as a completely uncovered option prior to expiration. Been reading the posts on calendar spreads and this has got me thinking about setting up my own. Calendar spreads allow traders to construct a trade that minimizes the results of time. It is something contrary to a conventional calendar spread. My very first reverse calendar spread Hello all! A reverse calendar spread is a type of unit trade that involves buying a short-term option and selling a long-term option on the same underlying security with the same strike price. Reverse Calendar Spread Reverse Calendar Spread CBOE Volatility Index Futures Reverse Calendar Spreads This Microsoft Excel® dashboard displays a depth-of-market (DOM) view of CBOE Volatility Index futures weekly reverse calendar spreads. A reverse calendar spread is a type of unit trade that includes buying a short-term option and selling a long-term option on a similar underlying security with a similar strike price.

Reverse Calendar Spread 2024. A reverse calendar spread is basically a brief position in a standard calendar spread. Been reading the posts on calendar spreads and this has got me thinking about setting up my own. A calendar spread is a derivatives strategy that involves buying a longer-dated contract to sell a shorter-dated contract. Start Date Month: / Day: / Year: Date: Today Add/Subtract: Years: Months: Weeks: Days: Include the time Reverse Calendar Spread. We invite you to attend an interactive virtual information session to meet some of our Rotational Colleagues, learn more about the program, about Pfizer. Reverse Calendar Spread 2024.

Date Calculator: Add to or Subtract From a Date Enter a start date and add or subtract any number of days, months, or years.

A reverse calendar spread is a type of unit trade that includes buying a short-term option and selling a long-term option on a similar underlying security with a similar strike price.

Reverse Calendar Spread 2024. This can be either two call options or two put options. Some holidays and dates are color-coded: Red -Federal Holidays and Sundays. My very first reverse calendar spread Hello all! These calendars are great for family, clubs, and other organizations. Google Calendar Outlook/iCal Career Center Hours.

Reverse Calendar Spread 2024.