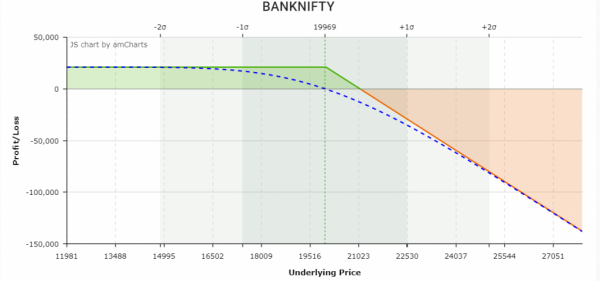

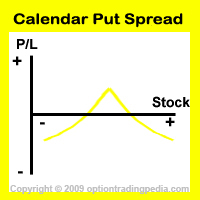

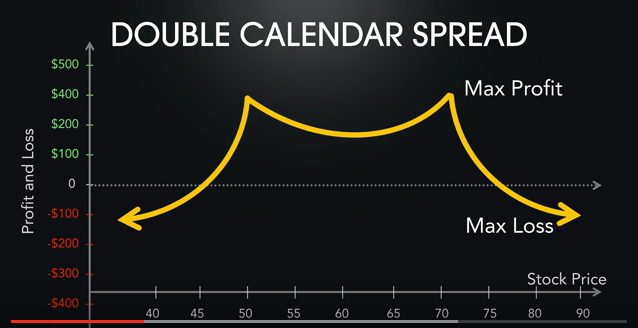

Calendar Spread Strategy 2024. Key Takeaways A calendar spread is a derivatives strategy that involves buying a longer-dated contract to sell a shorter-dated contract. One way to make money with options is through something called a calendar spread (also called a "time spread"). One of the more "complex" strategies is the ratio calendar spread, a way to initiate a position with a directional bias while utilizing the spread of the implied volatilities across two months to enable a smaller cash outlay, hence the calendar portion of the spread. Here are strategies similar to a calendar spread: Bull Calendar Spread – Just like the calendar spread expect you sell near-term call options that are slightly out-of-the-money because you think the stock will go up in value. All other charges as well as taxes and other statutory/Exchange charges continue to apply. A calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. This strategy is established for a net debit (net cost), and both. Bear Calendar Spread – Just like the calendar spread expect you sell near term put options that are slightly out-of.

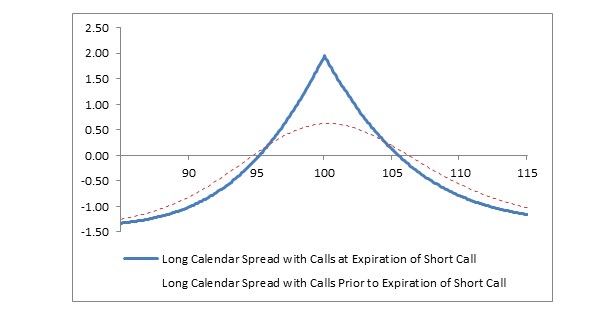

Calendar Spread Strategy 2024. The goal with this options trading strategy is to profit from differences in implied volatility between expiration cycles and/or the passage of time with a directionally neutral strategy. A long calendar spread is a good strategy to use when you expect prices to expire at the value of the strike price you are trading at the expiry of the front-month option. This strategy is established for a net debit (net cost), and both. It minimizes the impact of time on the options trade for the day traders and maximizes profit. A calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Calendar Spread Strategy 2024.

The use of a calendar spread permits a trader to take advantage of the backwardation that tends to be present in highly volatile market.

A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias.

Calendar Spread Strategy 2024. Options on the Buy and Sell side are of the identical type with the same strike price. Pam Skillings, interview expert and Co-Founder of Big Interview, will provide advice on how to ace your interview. How to Use Calendar Spreads To Control The Volatility in Coming Days. A long calendar spread is a good strategy to use when you expect prices to expire at the value of the strike price you are trading at the expiry of the front-month option. The goal with this options trading strategy is to profit from differences in implied volatility between expiration cycles and/or the passage of time with a directionally neutral strategy.

Calendar Spread Strategy 2024.