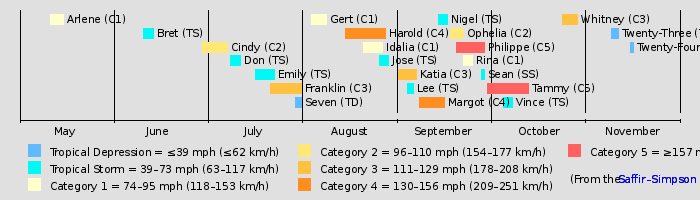

Calendar Year Hurricane Deductible 2024. Calendar Year Hurricane Deductible Described Hurricane Deductible issued by us or another insurer in our insurer group: Can be exhausted only once during each calendar year; and Applies to loss to covered property caused by one or more hurricanes during each calendar year. If the deductible is exhausted in a covered hurricane loss, a subsequent hurricane loss in the same year would not be subject to the deductible. That means that the deductible can be exhausted only once during each calendar year. Once the amount of covered hurricane loss in a calendar year exceeds your Hurricane deductible amount, the Hurricane deductible amount is satisfied. The hurricane deductible must be listed as a dollar amount, even if the deductible is listed as a percentage amount. This means that, once the amount of covered hurricane loss in a calendar year (i.e., January through December) exceeds your Hurricane deductible amount, the Hurricane deductible amount is satisfied. The IRS today released an advance version of Rev. When is a hurricane deductible triggered?

Calendar Year Hurricane Deductible 2024. It is important to note that hurricane deductibles are applied on a calendar year basis. Any subsequent hurricane losses in the same year then will be subject to your policy's All Other Perils. Please note that this statute does not apply to non-admitted insurers or commercial property insurance policies. When is a hurricane deductible triggered? The Reinsurance Program transfers financial flood risk to private markets to help strengthen the financial framework of the National Flood Insurance Program. Calendar Year Hurricane Deductible 2024.

Once the amount of covered hurricane loss in a calendar year exceeds your Hurricane deductible amount, the Hurricane deductible amount is satisfied.

The next phase of increases will take effect this year.

Calendar Year Hurricane Deductible 2024. A hurricane, or named storm, deductible is applied separately from standard perils deductibles and is typically a higher dollar amount, meaning a policyholder would be responsible for a larger portion of any loss. This means that, once the amount of covered hurricane loss in a calendar year (i.e., January through December) exceeds your Hurricane deductible amount, the Hurricane deductible amount is satisfied. It can be expressed as a fixed dollar deductible or, more commonly, as a percentage of the home's insured value, which can vary. The Commerce Department is expected this week to conclude some Chinese manufacturers are illegally dodging tariffs by assembling solar equipment in other Asian. If the deductible is exhausted in a covered hurricane loss, a subsequent hurricane loss in the same year would not be subject to the deductible.

Calendar Year Hurricane Deductible 2024.