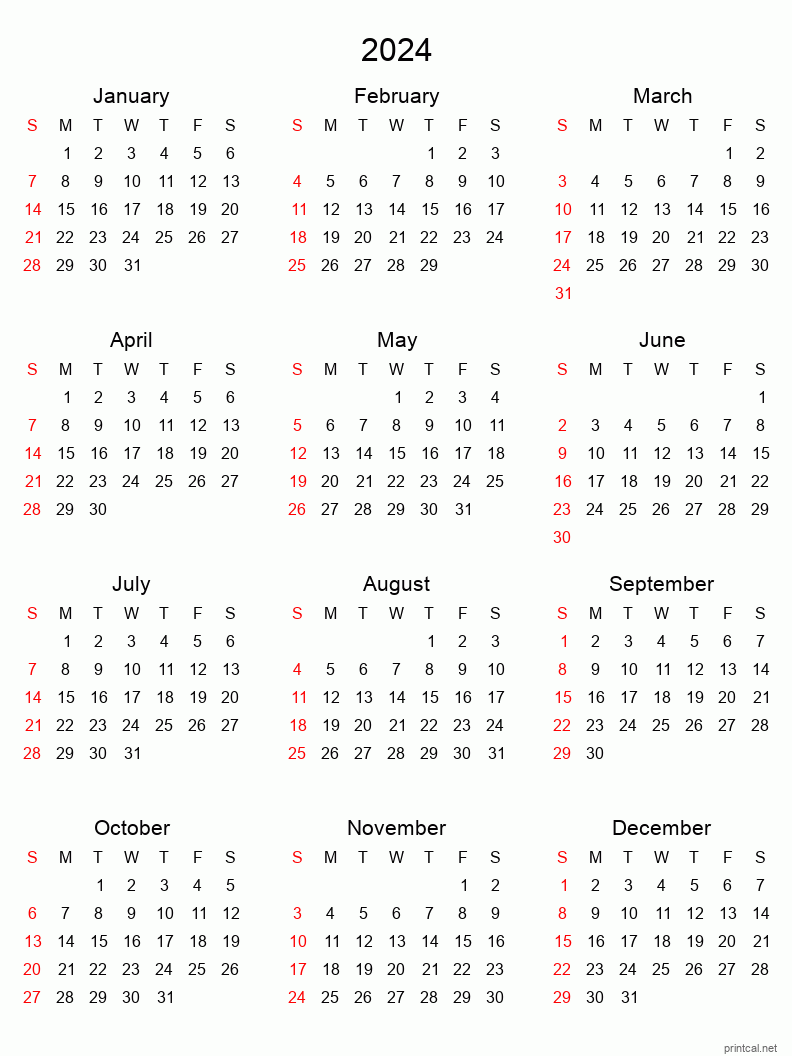

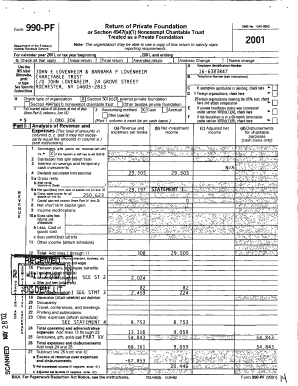

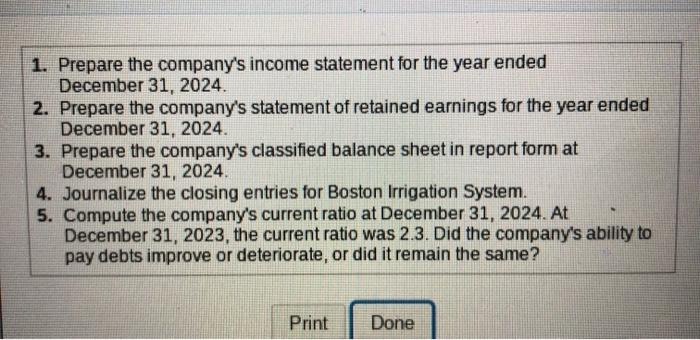

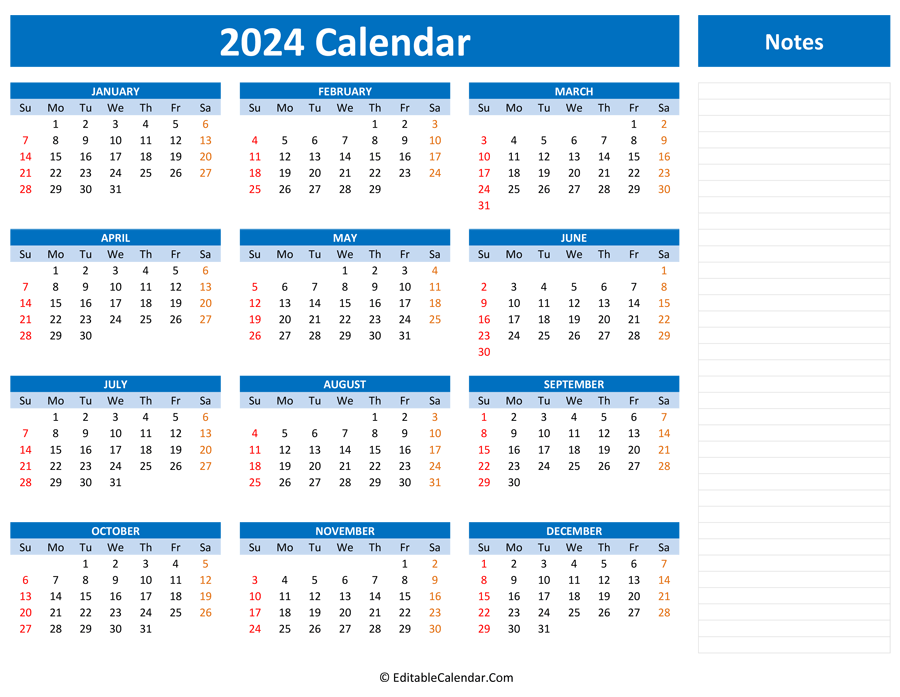

Calendar Year End 990 Due Date 2024. If a due date falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day. Some typical uses for the Date Calculators; Date Calculators. To use the table, you must know when your organization's tax year ends. If a due date falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day. Some holidays and dates are color-coded: Red -Federal Holidays and Sundays. To use the table, you must know when your organization's tax year ends. The due dates for the first three payment periods don't apply to you. Duration Between Two Dates – Calculates number of days.

Calendar Year End 990 Due Date 2024. If a due date falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day. Duration Between Two Dates – Calculates number of days. To use the table, you must know when your organization's tax year ends. The due dates for the first three payment periods don't apply to you. Some holidays and dates are color-coded: Red -Federal Holidays and Sundays. Calendar Year End 990 Due Date 2024.

Most of the due dates discussed in this publication are also included in the online IRS Tax Calendar for Businesses and Self-Employed, available at IRS.gov/TaxCalendar.

To use the table, you must know when your organization's tax year ends.

Calendar Year End 990 Due Date 2024. If a due date falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day. Duration Between Two Dates – Calculates number of days. Some typical uses for the Date Calculators; Date Calculators. To use the table, you must know when your organization's tax year ends. The due dates for the first three payment periods don't apply to you.

Calendar Year End 990 Due Date 2024.