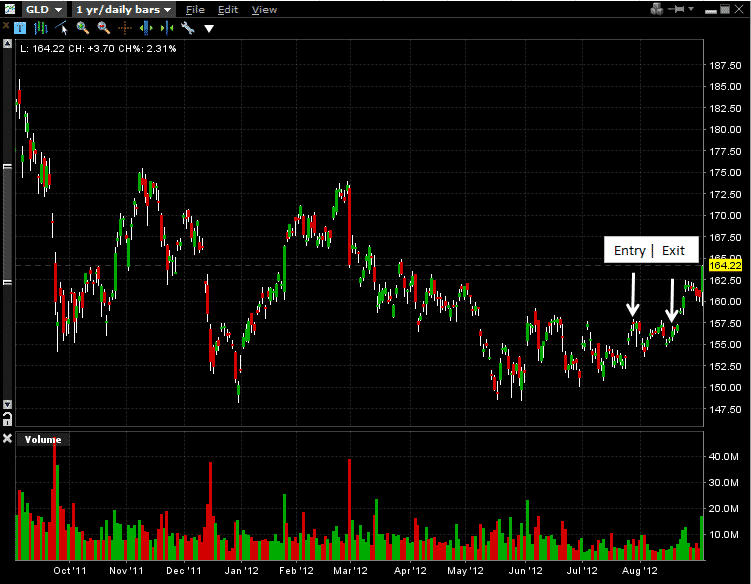

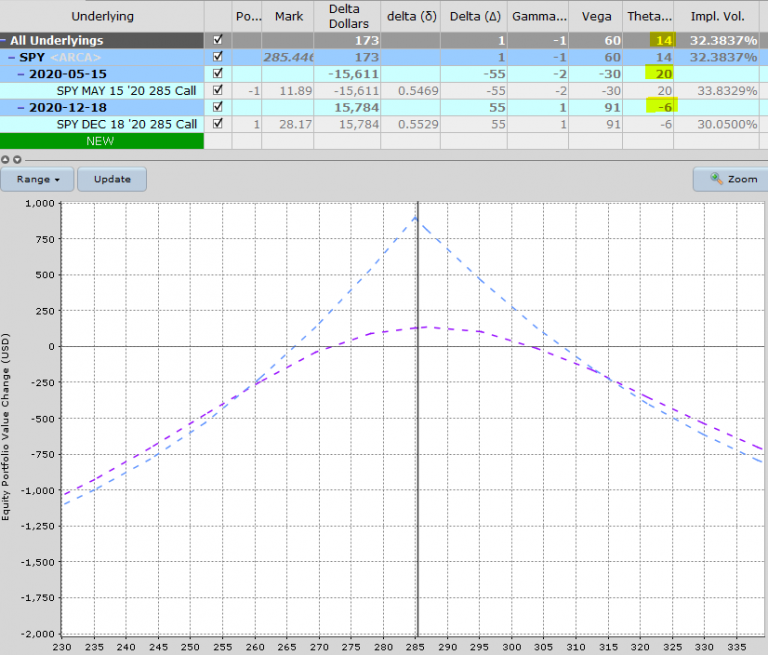

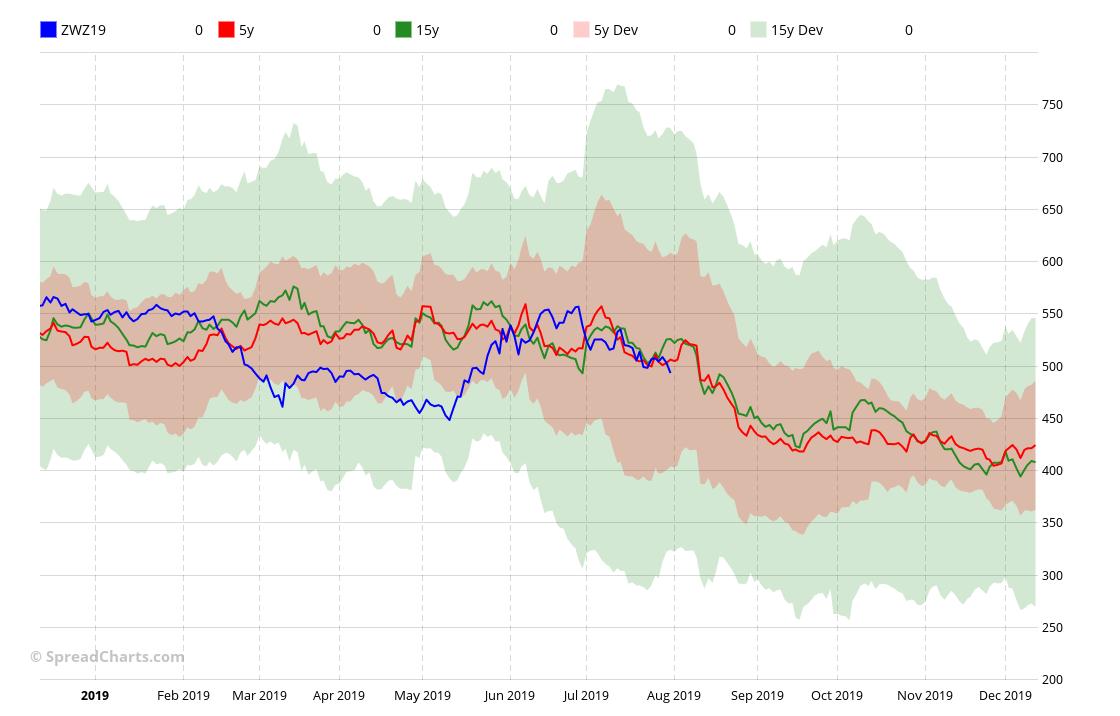

Calendar Spread Futures 2024. A calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Click the arrow next to your pre contract to view all of the listed spreads that include the symbol. In such case, look for a "Fit to page" or "Reduce/Enlarge" option in your printer's preferences dialog. Weekly calendar with federal holidays (US) and common observances. Calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Calendar spreads may be executed in a bullish or bearish fashion, depending on the position taken in the near month contract. In most cases, there will be a loss in. These calendars are great for family, clubs, and other organizations.

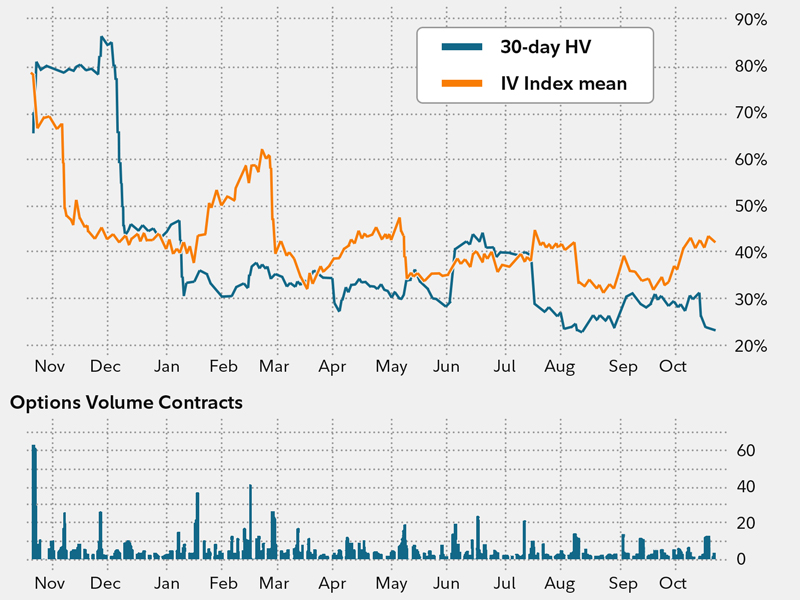

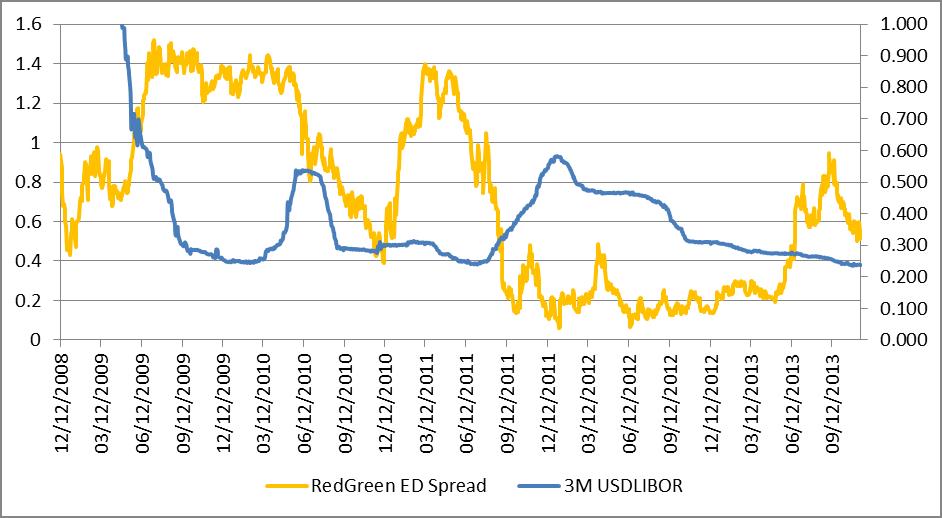

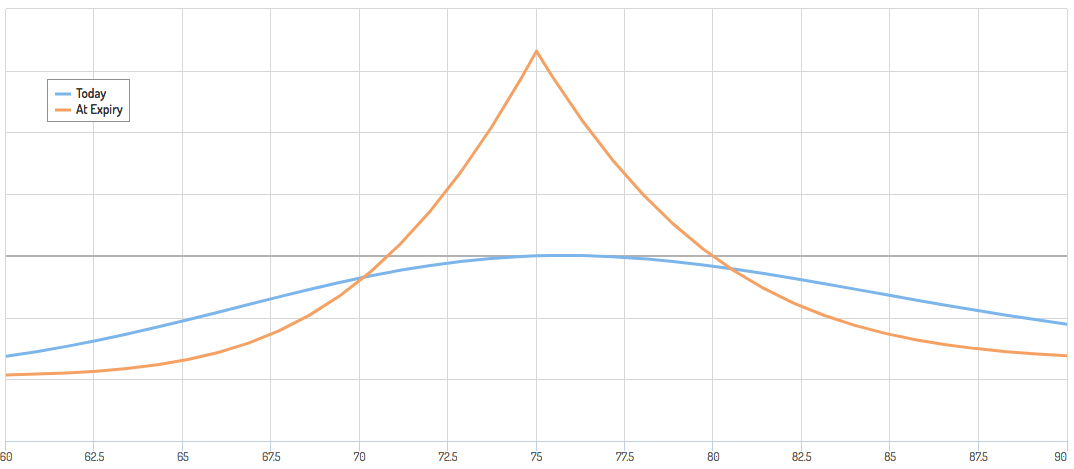

Calendar Spread Futures 2024. A futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to capitalize on a discrepancy in price. Following this decline in implied volatility, the breakeven price. Weekly calendar with federal holidays (US) and common observances. Gordon Scott When market conditions crumble, options are a valuable tool for investors. Futures contracts are grouped together by market category. Calendar Spread Futures 2024.

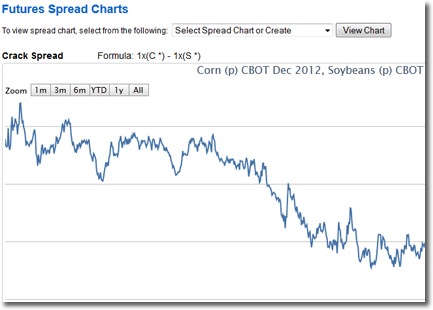

Calendar Soybean futures are an easy, liquid tool for speculating or hedging against price movements for one of the world's most widely grown crops.

These calendars are great for family, clubs, and other organizations.

Calendar Spread Futures 2024. Some investors tremble at the mention of the word options, but there are many options strategies available to. The Futures Expiration Calendar shows the date on which each futures contract will expire. Following this decline in implied volatility, the breakeven price. One of China's biggest shadow banks skipped payments on several investment products, sparking rare protests in Beijing as the fallout from a deepening property slump spreads to the financial sector. A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another month.

Calendar Spread Futures 2024.