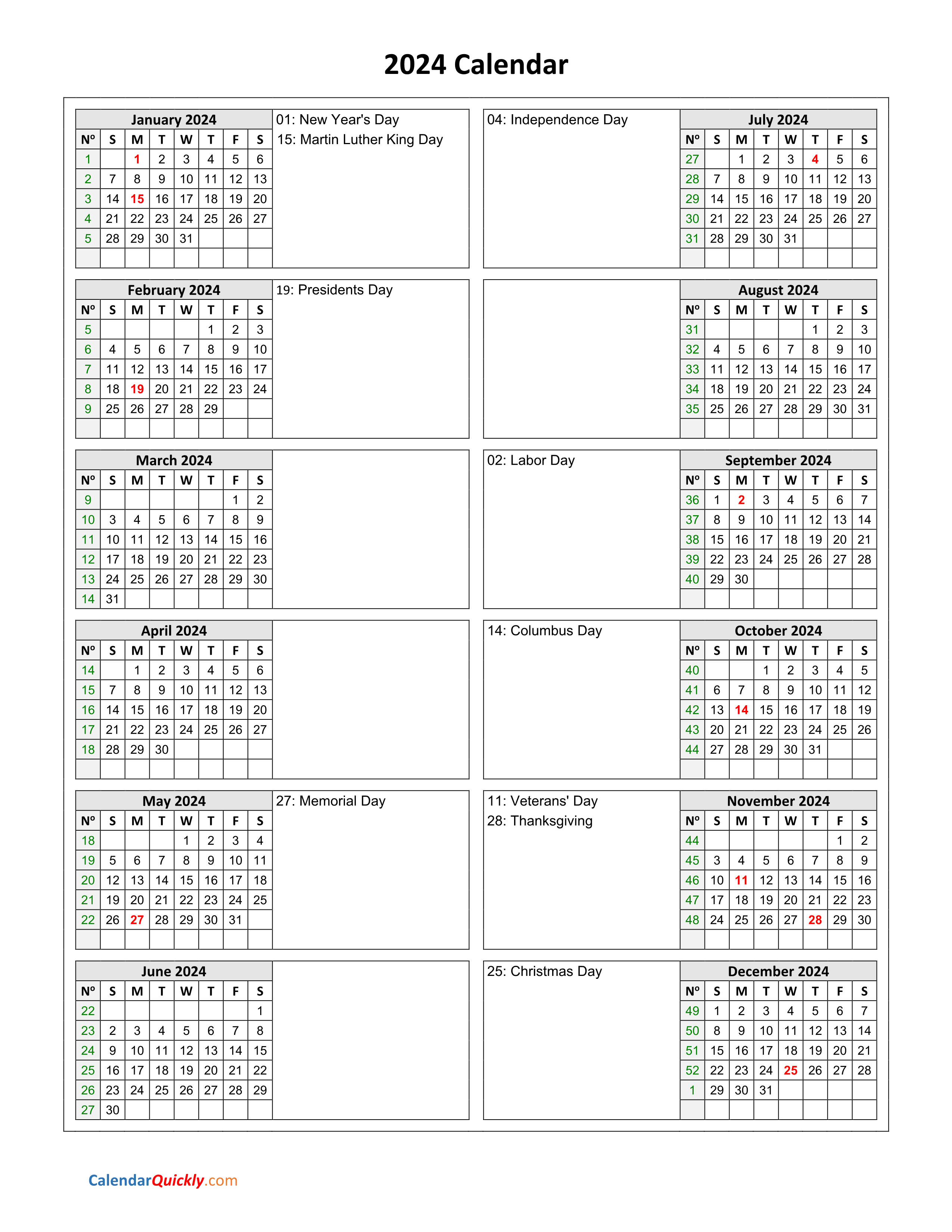

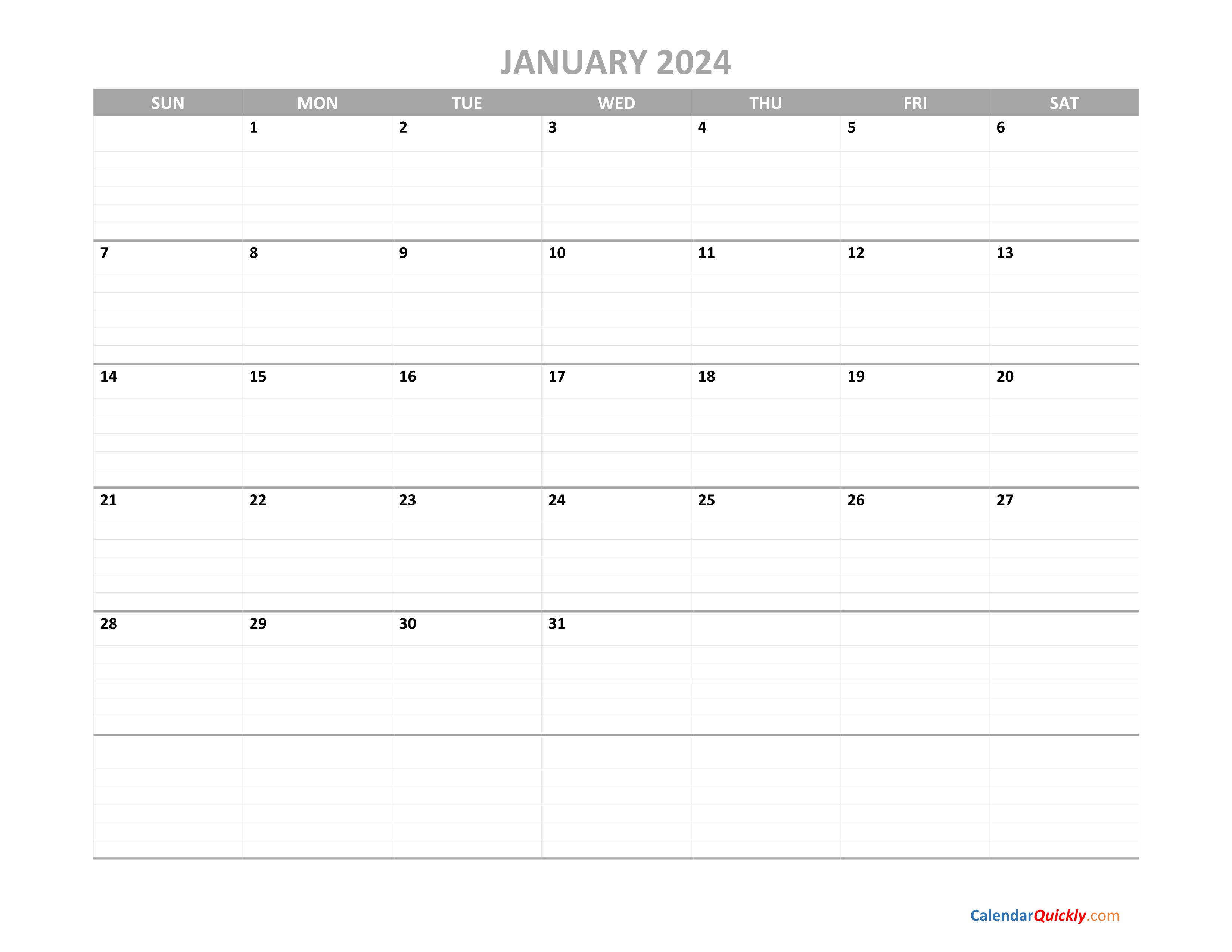

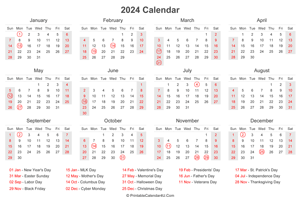

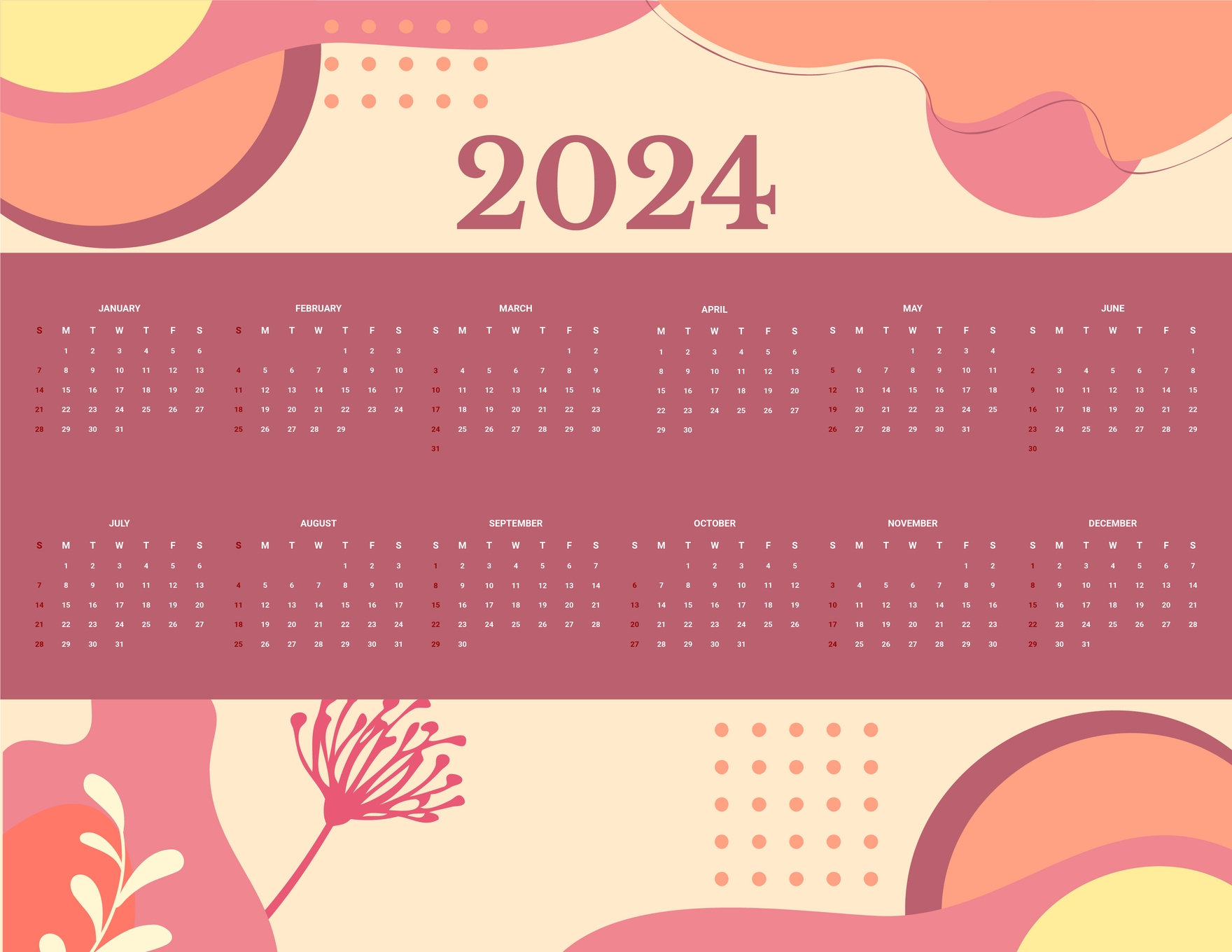

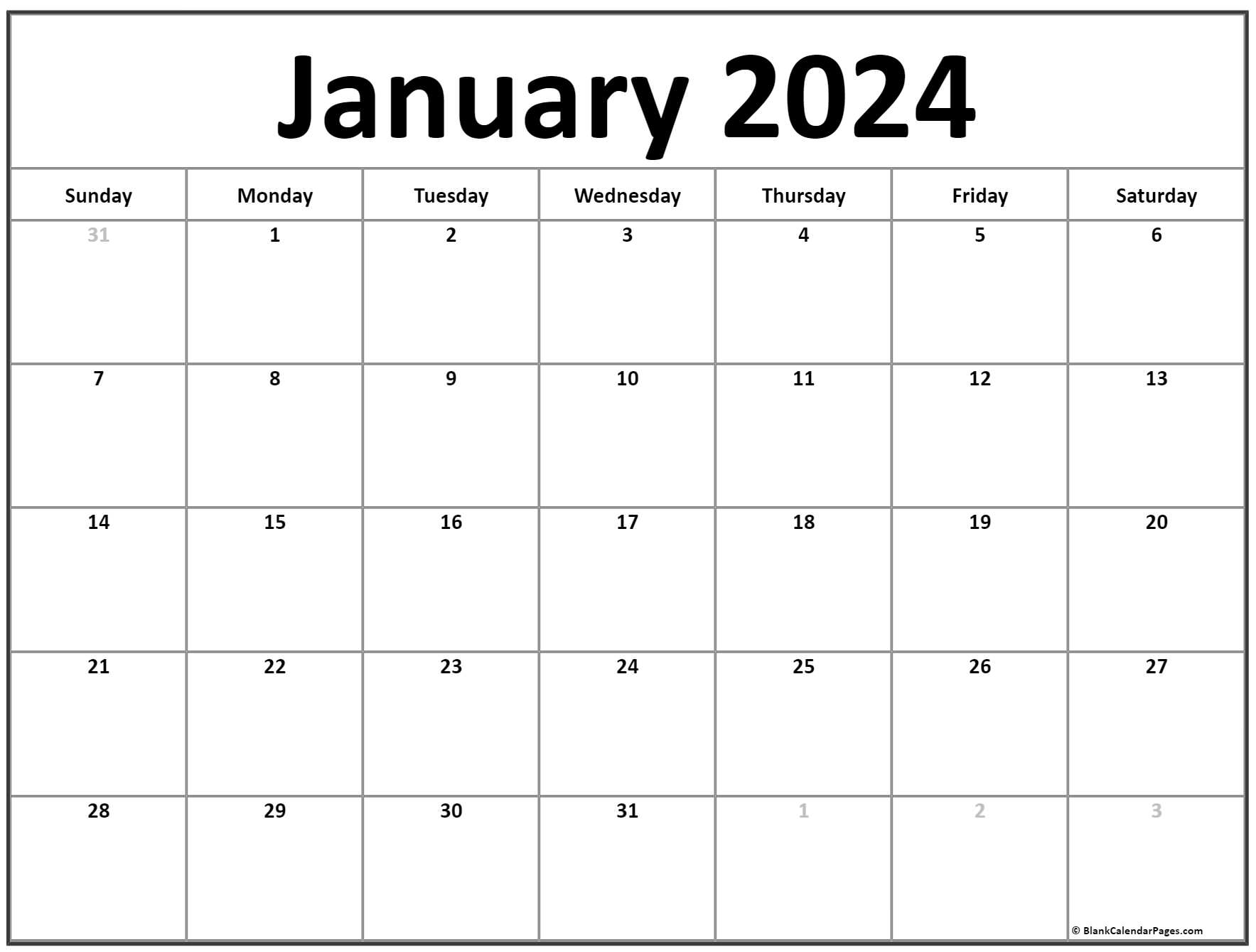

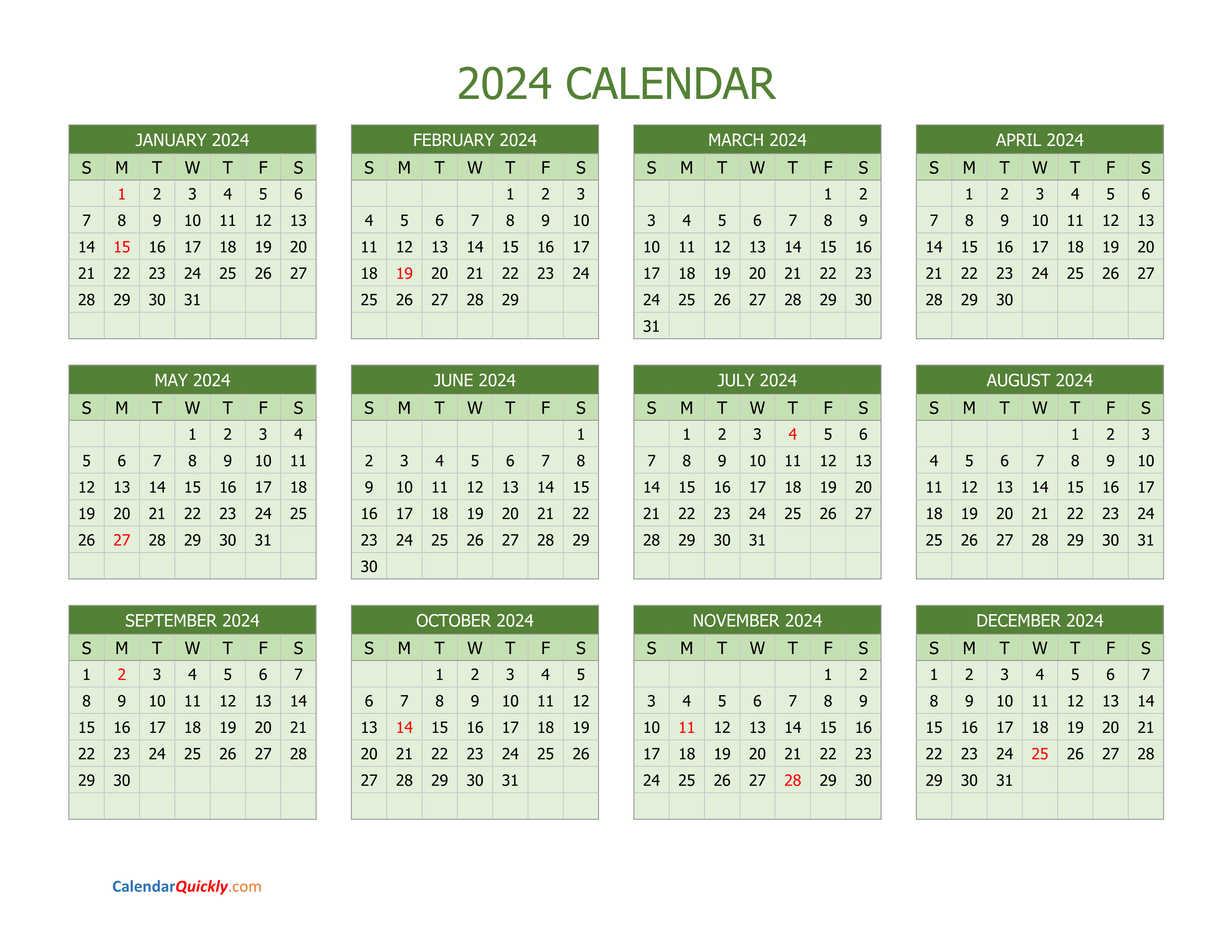

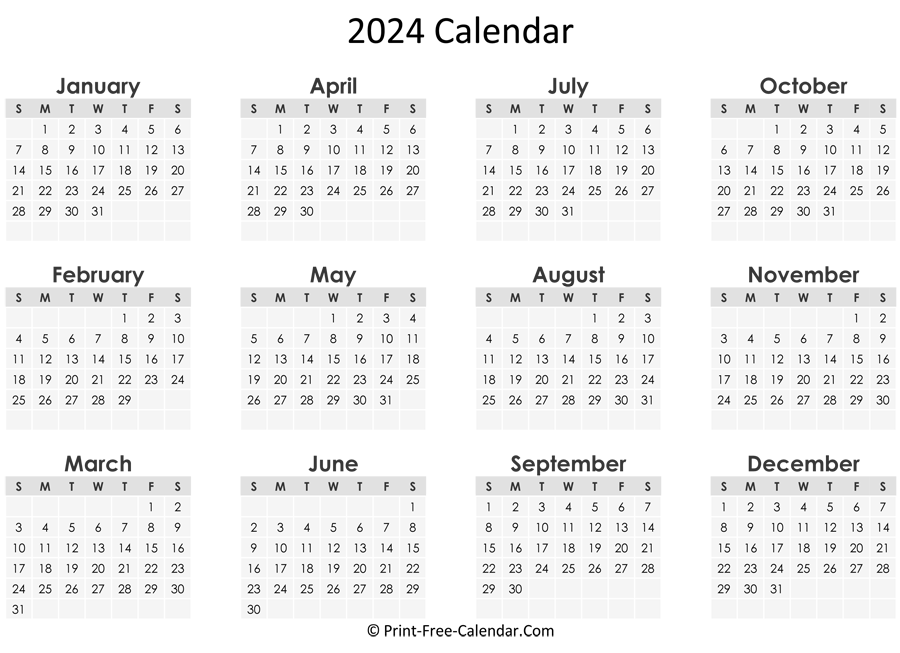

Calendar Year Taxpayer 2024. A "tax year" is an annual accounting period for keeping records and reporting income and expenses. Pass-through entities may, but are not required to, make quarterly estimated composite tax payments. This is also the deadline to file an extension request. Generally, if the due date falls on a Saturday, Sunday or legal holiday, the due date will be the next date that isn't a Saturday, Sunday or legal holiday. This calendar is also available in Spanish. Downloadable calendars for fiscal and calendar year pay schedules. The final regulations reflect changes made by the Taxpayer First Act (TFA) to increase e-filing without undue hardship on taxpayers. The IRS Tax Calendar for Businesses and Self-Employed is available online at IRS.gov/TaxCalendar.

Calendar Year Taxpayer 2024. What is the income tax rate in Iowa? Downloadable calendars for fiscal and calendar year pay schedules. Over the next year the Taxpayer Relief Fund is. It's never to early to start tax planning and your tax withholding. This paycheck calculator can help estimate your take home pay and your average income tax rate. Calendar Year Taxpayer 2024.

Fiscal and Calendar Year Pay Calendars.

Taxpayers filing early can expect their refunds to be processed from this date onwards.

Calendar Year Taxpayer 2024. Over the next year the Taxpayer Relief Fund is. The final regulations reflect changes made by the Taxpayer First Act (TFA) to increase e-filing without undue hardship on taxpayers. Pass-through entities may, but are not required to, make quarterly estimated composite tax payments. Semimonthly filers are required to file quarterly returns. The IRS Tax Calendar for Businesses and Self-Employed is available online at IRS.gov/TaxCalendar.

Calendar Year Taxpayer 2024.